travel nurse salary taxes

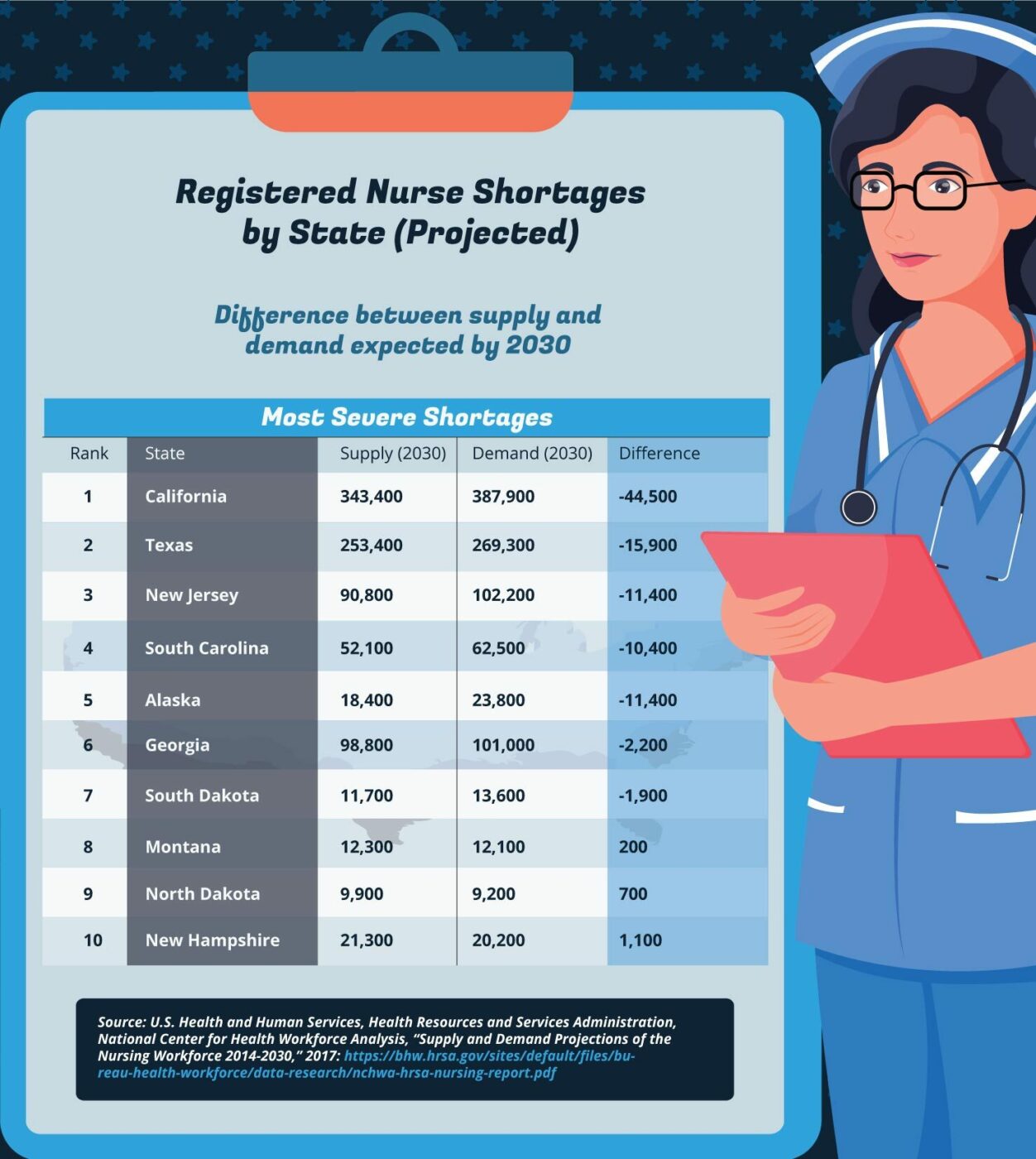

The highest-paying states are New York California and Idaho while the lowest reported salaries are in Louisiana and North Carolina. 24 for taxable income between 85526 and 163300.

What Is Travel Nursing Academia Labs

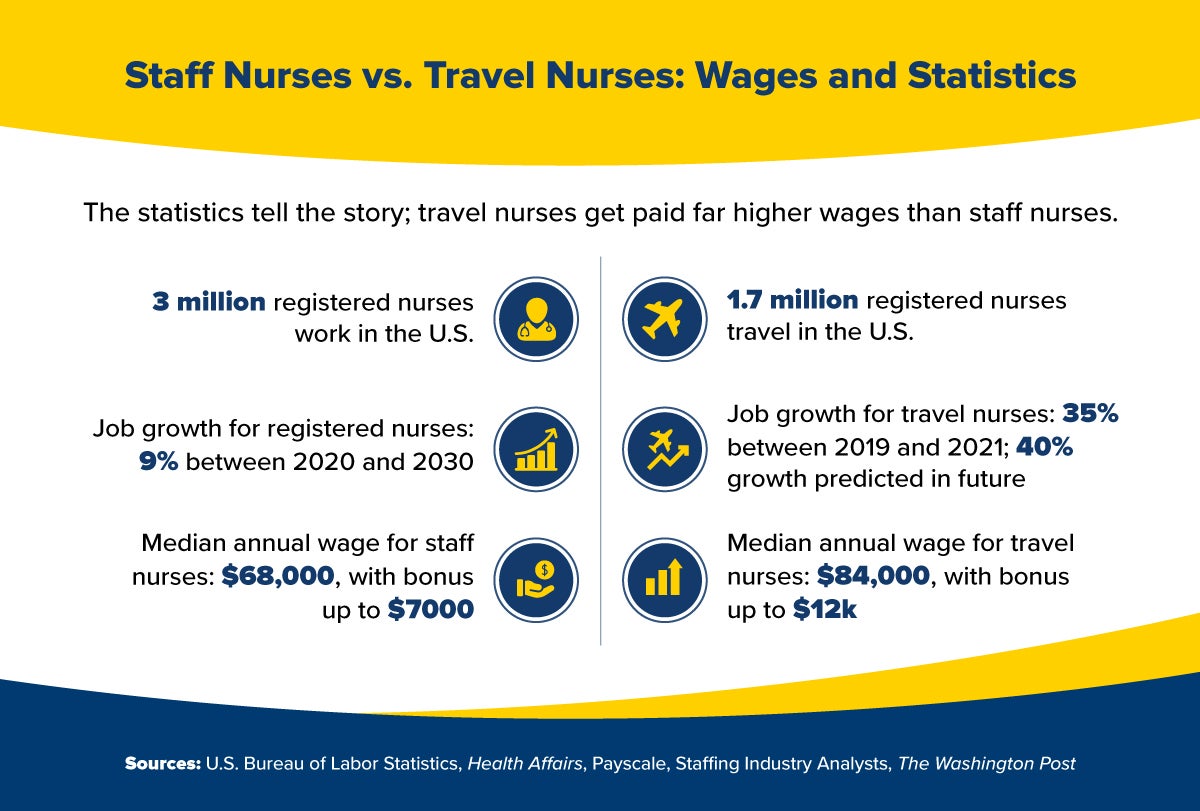

The average travel nurse salary varies greatly depending on the work assignment.

. If a travel nurse earns 30000 per year he could end up paying more than one-third of his income in taxes and bills. This means travel nurses can no longer deduct travel-related expenses such. Labor Delivery Travel Nurse.

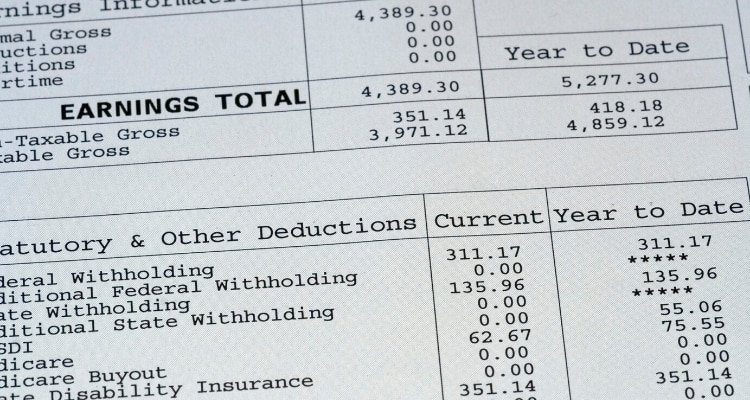

You are not entitled to tax-free money just because you are a nurse who is taking a 13-week contract in a new state. These stipends are not taxed since they are classified as. You will also need to pay estimated taxes since there are no tax withholdings for independent.

The monthly salary for travel nurses averages out to 9790 and may vary depending on hours worked or bonuses. That means that 2000-mile drive to the new assignment and back with a capped 300 travel pay each way is no longer deductible. 12 for taxable income between 9876 and 40125.

Unfortunately there is no straight answer. 22 for taxable income between 40126 and 85525. A 65 per hour pay rate works out to closer to 20 per hour of taxable income with the rest.

Compensation is one of the most talked-about topics when it comes to travel nursing. Give us a call at 8008660407 to discuss optimizing your pay to better suit your individual circumstances. If a travel nurse is not qualified to receive tax-free stipends the rate will be the similar 40-80hour but taxes will apply to the whole amount.

Even though North Carolina has the. If you are a travel nurse working outside of your tax home you will get a total compensation package that. Average Pay for Travel Nurses.

Travel nurse taxes are due on April 15th just like other individual income tax returns. A travel nurse salary depends on multiple. Your listed bill rate typically takes all of this into account.

RNnetwork creates custom pay packages for every travel nurse job. If you worked 50 out 52 weeks in 2021 and your base pay hourly rate was 67 and your weekly travel stipend was 1085 you would have a total income of. Long story short it affects your compensation package as a traveler.

There are lots of travel nurses. Not deductible any more. Taxable Income and non-taxable income.

Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. I believe that it is not worth it without a tax home. Going to a seminar.

First things first you have to know this. As a travel nurse you can qualify for non-taxable income called stipends. Depending on travel location these practitioners can earn.

You will still make more money. The average annual salary for travel nurses also varies.

Complete List Of Average Nursing And Travel Nursing Salaries By State By Nomad Health Nomad Health Medium

Travel Nurse Salary Comparably

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

What Goes In To Travel Nurse Pay Packages Nurse First Travel

:max_bytes(150000):strip_icc()/Traveling-Nursing-Jobs-Are-Paying-Now-More-Than-Ever-But-Do-They-Pay-Off-Long-Term-AdobeStock_39849691-231018122-2000-3071d5995b194e6ca60a195d84db9fe7.jpg)

Travel Nursing Jobs Are Paying More Than Ever But There S A Catch

Travel Nurse Taxes Overview Tips

How To Read Understand Your Nurse Pay Stub Nurse Money Talk

How To Make The Most Money As A Travel Nurse

Ultimate Travel Nurse Salary Guide 1mil Jobs Analyzed March 22

How To Evaluate Travel Nursing Pay Packages On Facebook Bluepipes Blog

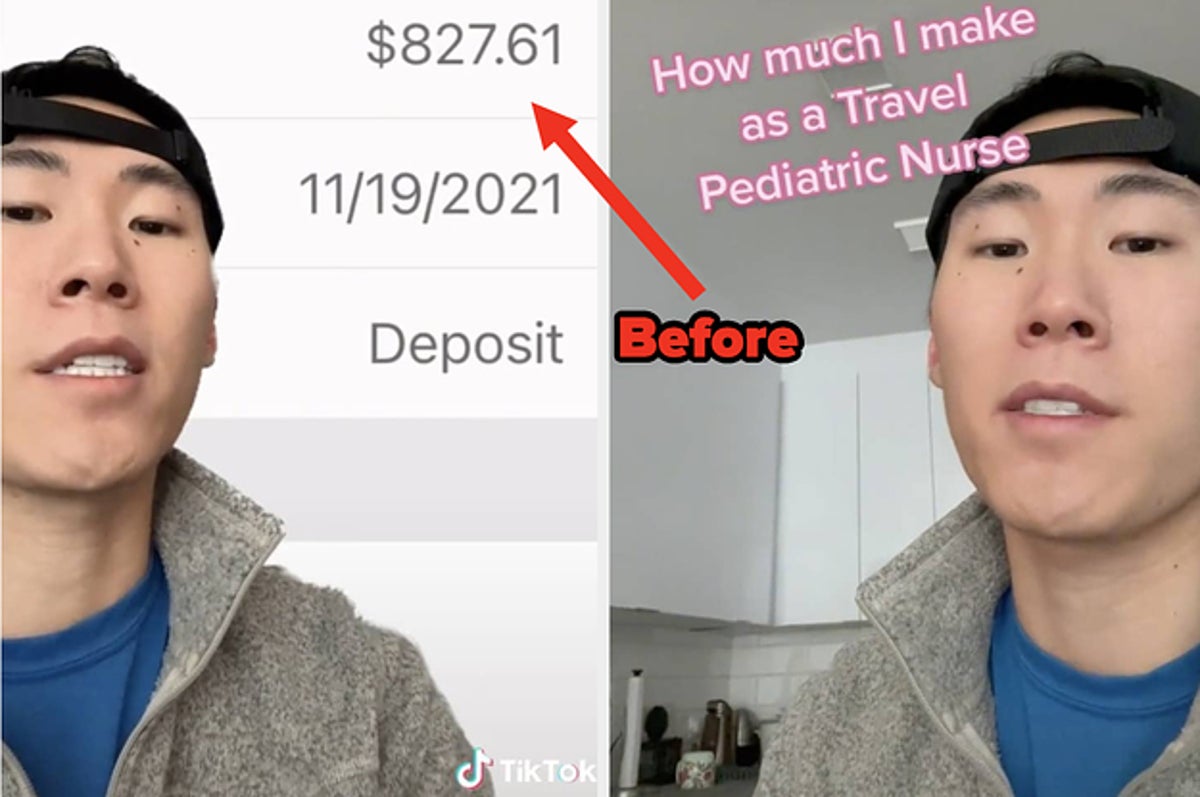

Tiktok Traveling Nurse Shares Salary

7 Ways To Increase Your Travel Nurse Salary Mas Medical

Travel Nurse Pay Breakdown How I Make 19 600 A Month Youtube

How Much Rent Do I Need To Pay Tax Home Q A For The Travel Nurse Therapist Tech By Nomadicare Medium

How To File Your Taxes As A Travel Nurse Ioogo

Travel Nursing 101 How To Be A Travel Nurse More Tnaa

Travel Nurse Taxes All You Need To Know Origin Travel Nurses